Powered by RedCircle

Listen at: Spotify | Apple Podcast | YouTube | Stitcher | RadioPublic

Welcome to Episode 110!

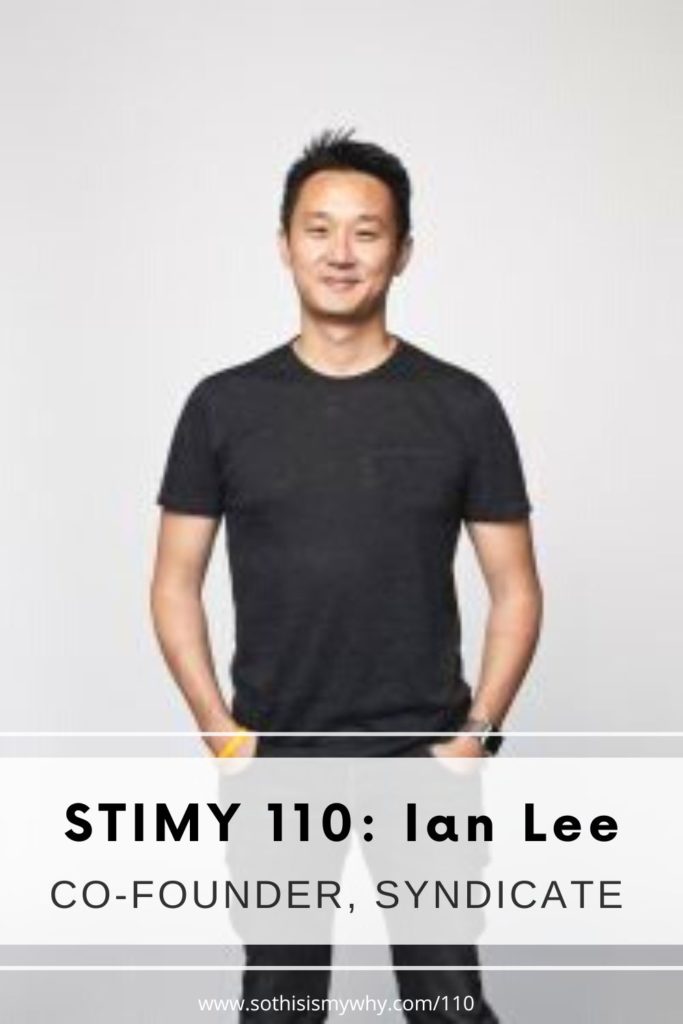

STIMY Episode 110 features Ian Lee.

Ian Lee is the co-founder of Syndicate: a decentralised investing protocol & social network by the likes of A16Z, IDEO, Kleiner Perkins, Uniswap, Coinbase, Opensea, circle & Ledger. He is also the former founding member of IDEO Colab and Head of crypto & blockchain at Citi.

But before all that, he was an artist.

Then a designer. Before pivoting into marketing & advertising, investment banking and finally, consulting.

Where he ended up being diagnosed with cancer.

His world shrunk into 3 month timeframes, because he just didn’t know if he would live beyond each three month period.

Ian’s worldview changed. He was and remains afraid to try new things.

In Part 1 of Episode 110, our discussion centres around the fundamental question of: How do we measure our life?

Opening with a viral Tweet that Ian wrote, inspired by a Harvard Professor called Clayton Christensen where he learned that:

The best strategy in life is an emergent one.

Don’t plan life in 5-10 year spans. Instead go all-in on what you have the most conviction, passion & excitement for in 12-18 month increments.

You’ll learn more, grow faster & outperform others not as into it as you.

You’ll learn how and why in this episode, and so very much more in this episode with Ian Lee.

PS:

Want to be the first to get the behind-the-scenes at STIMY & also the hacks that inspiring people use to create success on their terms?

Don’t miss the next post by signing up for STIMY’s weekly newsletter below!

Who is Ian Lee?

Ian Lee loved art and engineering while growing up. He loved creating things with his hands and surprisingly, his father was the one who encouraged Ian to go to art school!

But once there, Ian really that there were a lot of other people who were art prodigies.

So he switched to design and double majored in economics. Which was at the time an unusual combination & made for some surprising difficulties!

- 2:41 Don’t plan your life in 5 to 10 year spans

- 3:49 Going to art school instead of science?!

Life Isn’t Linear

Ian’s life was thrown for a loop when he was diagnosed with cancer. It completely revamped his perspective on life and how he approaches challenges and things that interest him.

We also talk about why everyone should pursue the things they’re passionate about in 12-16 month increments, and ditch those impractical 10 year life plans!

- 6:07 Being diagnosed with cancer

- 7:43 Living in 2 to 3 month increments

- 9:26 Exploring rabbit holes

- 19:10 Life isn’t a linear progression

- 20:36 Letting go of his need for obsessive planning

- 22:15 Is there a place for long term vision and planning?

- 24:38 Would Ian really do anything differently?

- 27:59 Knowing when to quit

- 30:44 How to plan for a pivot

- 35:39 Juggling art and business in his CV

- 42:45 Mentors

- 48:53 Fostering relationships with mentors

Powered by RedCircle

Ep 110 PART 2: Where the hell is everybody?!

In Ep 110 Part 2, Ian talks about all things Web3.

From going into banking to being tasked with finding out about bitcoin, how he ended up being the Head of Crypto & Blockchain, all things decentralised social networks and what he’s now trying to achieve at Syndicate.

Highlights:

- 2:26 Being ridiculed by bankers

- 4:56 Learning about Bitcoin

- 11:37 Attending Bitcoin conferences as a “suspicious” person

- 13:38 Forking the Bitcoin network with Citi coin

- 17:43 Leaving Citi

- 18:45 Being crushed by… Ethereum?!

- 24:40 Joining IDEO

- 27:15 Meeting his co-founder, Will

- 32:33 Creating the YouTube of web3 investment

- 40:15 Collectives

- 42:32 Working towards Balaji’s vision of a network stake?

- 44:08 Singapore rice dishes

- 47:44 Does everyone have just 1 calling?

If you’re looking for more inspirational stories, check out:

- Chrissy Hill: General Counsel, Parity Technologies; former GC & COO at Tony Blair’s Institute for Global Change

- Kendrick Nguyen: Co-founder, Republic; former GC of Angellist

- Zeneca: Former professional poker player turned NFT founder, investor & educator with 360k Twitter followers

- Nicole Quinn: General Partner, Lightspeed Venture Partners – known as the Celebrity Whisperer who’s invested in Sophia Amoruso, Lady Gaga (HAUS), Jessica Alba, Gwyneth Paltrow etc.

- Richard Lui: MSNBC & NBC News TV Anchor, and Peabody & Emmy award winner

- Adrian Tan: King of Singapore & President of Singapore’s Law Society

If you enjoyed this episode, you can:

Leave a Review

If you enjoy listening to the podcast, we’d love for you to leave a review on iTunes / Apple Podcasts. The link works even if you aren’t on an iPhone. 😉

Patreon

If you’d like to support STIMY as a patron, you can visit STIMY’s Patreon page here.

External Links

Some of the things we talked about in this STIMY Episode can be found below:

- Ian Lee: Twitter, LinkedIn

- Syndicate

- Subscribe to the STIMY Podcast for alerts on future episodes at Spotify, Apple Podcasts, Stitcher & RadioPublic

- Leave a review on what you thought of this episode HERE or the comment section of this post below

- Want to be a part of our exclusive private Facebook group & chat with our previous STIMY episode guests? CLICK HERE.

STIMY 110 Part 1: Ian Lee [Founder, Syndicate DAO] - How Do You Measure Your Life?

===

Ian Lee: I was diagnosed with the early stage form of cancer. That threw me through a loop, obviously.

And one of the things that happened was I got taken out of consultant at that time. I was actually very, very lucky in the sense that I caught it early, but I was, recovering for a number of months. And when you go through an event like that, it really makes you kind of reevaluate everything.

Your choice is up to that point, but also like how you're gonna live whatever amount of life that, that you have left. How are you gonna live, you know, do that potentially differently.

Ling Yah: Hey everyone!

Welcome to episode 110, part one of the So This Is My Why Podcast.

I'm your host and producer Ling Yah. And today's guest is Ian Lee, the co-founder of Syndicate, which is a decentralized investing protocol and social network that is backed by the likes A16Z, IDEO, Kleiner Perkins, Uniswap, Coinbase, Open Sea Circle, and Ledger.

He's also the former founding member of IDEO Colab and also head of Crypto and blockchain at Citi. Now, Ian's story is divided into two parts with part two being released this Wednesday because they talk about two very distinct parts of his life. Today's episode centers around the question of how do you measure your life.

Because you see, Ian first went to art school because he loved art, but soon realized that the world was full of art prodigies, and he wasn't one of those. So what did he do? He pivoted to design, then marketing and advertising, then investment banking and consulting before being diagnosed with cancer. Then his world shrunk into three month increments because he didn't know if he would live beyond the three months period each time.

As such, Ian's worldview understandably changed. He was and remains unafraid to try new things.

We talked about all that and also how Clayton Christensen, a Harvard Professor, has influenced Ian's perspective on how 10 year long life plans don't work and that we should all instead pursue the things that us the most in 12 to 18 month periods.

If you're trying to find a life purpose or just how to live your life to the fullest, then this is the episode for you.

So are you ready?

Let's go.

I thought we would start with a tweet you once wrote, where you said very interestingly that you shouldn't plan your life in five to 10 year spans. But that you should actually think in terms of 12 to 18 months.

I wonder how you came to that decision.

Ian Lee: I've always been someone since I was like a child who has been really planful. I was the type of person who would months before a trip or an event or something plan out everything to the nth level of detail. I would create spreadsheets and presentations and documents, and I'd like to have that level of detail and certainty with everything. So that extended to who I was and how I led my life.

And one of the things that always bothered me actually was that when I was a kid, I, I didn't really know what I wanted to be in life.

Like, there were people in my grade, they always wanted to be a lawyer. They always wanted to be a dentist. They always wanted to be a doctor. And I didn't really know what that was for myself. I had a lot of different and, seemingly very disparate interests. And I, I didn't really know what to make of that.

It came to a head when I had to choose what to focus on in college. And when I was in high school, I was really good at both math and engineering and then also art. And-

Ling Yah: It's an unusual combination.

Ian Lee: Yeah.

I mean, I think a lot of people actually, they have multiple talents. It's just that they cut 'em off pretty early and, and so somehow I had been able to maintain that up until that point. And I kind of on a whim decided to go into the field of art instead of engineering.

So I declined all of these schools that I had applied to and gotten into in the schools of engineering and, and went to school as a fine art major. And that kind of threw me for a big loop. And what ended up happening in the years after that was I first of all realized that actually I made the wrong choice.

That there were people in the art world that were infinitely better than me. And, and so what I needed to do was continue to pivot and find my way into things that I was really good at and really passionate about. And the reason I bring up this is because basically from then all the way until I came upon this discovery that, that you referenced, I had just been constantly changing myself.

I mean, I went from art then into design, then into marketing and advertising because that was the only industry that would hire someone with my background at that time.

And then from marketing, I learned about finance and then I went into finance. And then from finance, I went into investment banking, from invest banking to consulting.

And then I ended up actually being in consulting. Yeah. I ended up being in consulting for a long time, for almost eight years because consulting was sort of a playground for people like me where every two to three months you were changing the industry and, and the type of work that you were doing.

So it was like kind of really good for someone like me who didn't really know what they wanted to do, but just wanted to like, learn a lot of things. And it was, yeah, around the age of 30.

So this was, you know, pretty much more than 10 years after like making that initial decision to go into art, not engineering where I was still in, in the area of consulting, you know, hopping from project to project. Flying all over the world and going to different industries.

And honestly, I had a health situation. I was diagnosed with the early stage form of cancer. That threw me through a loop, obviously.

And one of the things that happened was I got taken out of consultant at that time. I was actually very, very lucky in the sense that I caught it early, but I was, recovering for a number of months. And when you go through an event like that, it really makes you kind of reevaluate everything.

Your choice is up to that point, but also like how you're gonna live whatever amount of life that, that you have left. How are you gonna live, you know, do that potentially differently.

I think many, many people have gone through this in different ways. But not everyone. I mean, I think it takes something pretty serious to kind of be forced to think about this, which I hope most people don't have to like, you know, go through an experience like the one that I did to real come to this realization.

There was a good period of time, like years actually, where I didn't know how long, I was gonna live.

Like, you would go into the doctor and, and you would get your quarterly scan to see if like it had spread or if it had metastasized or whatever, and you have no idea like what it's gonna say. It could say like, you're fine. It could also say like, it's getting worse.

And so literally I was living in three month increments. I mean, it wasn't even 12 to 18 month increments. It was like two to three month increments where it was like, okay, I go through an MRI or whatever. I've passed that mri, I know I'm okay, but I know I'm okay only until my next scan. Beyond that, I have no idea, right?

So when you live in two to three month increments, you start doing things very differently. Like, I immediately picked up sailing. So I learned how to sail in a span of two months. I just like went to all these courses. Like, you know, sailed every weekend and quickly accelerated in terms of my certifications, because I always wanted to sail.

Ling Yah: So it was just like a mental bucket list that you just ticking off as pretty much.

Ian Lee: I mean, just like knocking out as many as I could. Right. Well, actually, to be honest, it's a pretty random sequence.

I did other things. I'm trying to remember now at this point. I mean, this was over 10 years ago. I refreshed my programming skills at that point in time. I traveled a bunch. I bought a nice car even though I wasn't in the cars. So like,

Ling Yah: just so you could say you have a car.

Ian Lee: Yeah. There's all these like things that, you do. Yeah. You just live differently. Anyone who has been through cancer knows that you go through these scans for five years until, you've effectively been become free I guess of it.

And so for five years I was doing that.

I just like got up threw stuff in my bag. I had one bag and then I just got up and moved to New York. And just all of these things, so like for five years I was doing this. And that also trickled into like my professional kind of interest.

So instead of holding back on things that I thought were like interesting but not necessarily good for me professionally. I just instead said, you know, let's screw it. I'm just gonna like do this because I think it's just the most interesting. And what would happen is like once I went down those rabbit holes, they would lead to new rabbit holes that were just as if not more interesting.

And so I would say, Well, you know what? Screw it. I'm gonna go down that rabbit hole now.

Ling Yah: What was some of those rabbit holes?

Ian Lee: Yeah, for me, like, being in, the area of consulting I had been working in industries like automotive and aerospace and industrials and things like that, like industrial products, which are super interesting.

But I always had this like curiosity, I think because of my engineering background on technology and in particular obviously like software. Software became huge, like, you know, when I was in consulting. And so I always kind of like felt that part of me, art plus like math and engineering was like something that I had always missed.

And so I kept on like wanting in a way to get into the world of technology. And so it was actually because I was pulled off these consulting projects that I was thrown into this research division of, of the consulting firm to look at the impact of initially software as a service and also artificial intelligence on the consulting industry initially and like how it might disrupt our own business.

And then ultimately like the impact of emerging technologies more broadly on the industries in which our clients existed and, and we served. So that kind of was pretty fascinating because it obviously like leveraged a lot of my own knowledge about, you know, our business and, and our industries and the industries that I used to work in, like aerospace and automotive, but it also brought in this like technology software bend to it or lens to it.

I just love that and instead of going back into consulting, I elected to stay in this research arm and kept on just Deloitte researching emerging technologies. Yeah, yeah, yeah. So I, I worked at Deloitte as a consultant, and then I went into their global innovation office at the corporate level for a number of years.

And so, you know, I kept on going down that path.

One of the fields that I had studied both in, in business school and then after, was this field of disruption theory basically.

When I was in business school, I read this book called The Innovators Dilemma, which is my number one book, business book of all time, maybe just book of all time.

It was written by Clayton Christensen, a former consultant at bcg, professor at Harvard Business School. He was trying to answer this question, which I was obsessed with too, which was why do companies with infinite resources that achieve a large scale of success perpetually fail over time?

Like, why do they always get disrupted? And that is the title of the book, The Innovator's Dilemma. There's a whole bunch of interesting things there, but basically that, led me into this, this world of technology research, but also innovation research.

Very unfortunately Clayton Christensen, the author of that book, he was alive by that time, he had a stroke, kind of plus or minus a few years, like around when, when I had my incident. It caused him to be partially disabled. He had a hard time articulating himself in the ways that he, traditionally had.

After that event, he wrote a book called How Will You Measure Your Life? And this book was interesting to me because it took his research that he had done for decades in the area of the Innovators dilemma and applied it to how to live your Life, which I thought was just intellectually fascinating.

But the main takeaway for me at least, and conclusion from the book is he said that essentially the best strategy for a corporation is what he calls an emergent one. That's actually the one of the main conclusions from the Innovators Dilemma, which is that companies have these like 10 year strategic plans.

I mean, I'm not sure if they even do that anymore, but they have these like 10 year strategic plans, and I used to work on those as a consultant, right? Where you, like, you have a 2020 strategy where you have a 2030 strategy or 2050 strategy and like everything needs to be planned perfectly to get to that.

And what he says is that obviously in the world of technology and, rapid innovation, ten year strategies become obsolete by year two because the industry has completely changed. And that's a big part of why companies repeatedly fails that they design for conditions and, environments that are no longer relevant and they don't innovate by doing things that seem stupid at first, but actually are going to become really big.

That was the conclusion from his decades of research in the Innovators Dilemma. And he basically said that what companies should do around an emergent corporate strategy, is also what people should do with their life.

If you don't wanna be a dentist or a doctor or something like that, rather than planning out your life in 30 year, 40 year time spans, which I used to literally do and agonize over as in my twenties.

Just do what you think is most interesting and compelling, and you're most energized by over the next, like 12 to 18 months. And then just go from there and kind of let go of whatever exists outside of that frontier. And the reason he says that is because if you do that, if you throw your full self into those things, right, because you're genuinely passionate about that, what's gonna happen?

You are going to learn faster. You're gonna work harder and work more than other people. Not because it's work to you, but because you just find it interesting. Like, you know, you just can't stop thinking about it. And because you're gonna be more interested in it, because you're gonna grow and learn faster and because you're gonna work harder, you're actually gonna perform better than other people who are not interested in it.

And because you're gonna perform better, you're actually gonna be exposed to new opportunities and more opportunities than other people and even yourself that you didn't even realize.

Meaning it's going to open up new doors and new rabbit holes that you never knew existed if you hadn't done that in the first place. And so when I read that, I was like, two things. I was like, Oh my God, I've been kind of doing that all my life. From the moment that I decided to go into art and then realized that actually I was, you know, was more interested in something else I just hadn't done it as deliberately. I had just been agonizing over that process for over a decade.

And number two, that when you actually like what, you know, I, I add the historical perspective to see that when you do follow your interests and passions, which I somehow managed to be able to do over that decade that it ends up leading to better outcomes.

And so, given all of that and given, you know, where I was at at my life, given the situation that I had just gone through, at one point I just said maybe I should make this my life philosophy and my philosophy to work as well.

And once I embraced that, I just said, You know what? Screw it. Like, I have no idea where I'm going in life. I might not ever. Let's just go with it. From that point forward that's, that's what I've been doing.

So I haven't, you know, had a five year, 10 year plan. I've never even spent time on that anymore. I've just said that's the most interesting thing and I'm just gonna go like all into it.

And that's from there. What led me into joining City Ventures, for example, I was actually like looking at other opportunities. Opportunities that, I won't name names, but big tech companies that everyone would know. At that time I was choosing between big tech and city ventures.

Actually, like Big Tech was more attractive. Like it was the right thing to do. It was like it just looked better on your resume. But like, I just thought that the problem space that Citi Ventures at the time when I was looking at that opportunity was just more interesting to me. It just seemed more interesting. And so I joined it just because it was more interesting and that's where I learned about Bitcoin.

And then I was like, I don't know this, weird thing called Bitcoin just seems like the most interesting thing to me. Even though there's all this other interesting stuff in FinTech. Everyone else thinks Bitcoin is stupid. And thinks I might get fired by focusing too much in Bitcoin.

But I think it's really fascinating. So I just went head first into Bitcoin and, that just led me to all these series of things, and I just haven't stopped all the way up until today where, founded my own startup in the crypto web three space after all these years.

But, I had no intention of ever doing that and never planned or, or imagined that this would be where I'd be at this point in time.

Ling Yah: I love this. So it was a very long answer to your question. No, I loved it .

Ian Lee: You know, it's been my life. And I actually hope, unless you're like someone that is really set on being a doctor or a politician or something, and you just know that that's your thing. But if you're like me, which I think most people are, then I wish I had learned this in my teens.

I often think about what would've happened if I had embraced this earlier in my life. Like how much faster would I have learned and progressed. I mean, you know, I'm happy with where I am right now, and I'm, doing the best with what time I have left.

But I wish I had learned this earlier in my life, so I hope others do too.

Ling Yah: I love this answer because I've interviewed almost 100 plus people, and I was always driven from the very style of why do you do this and what drives you. And I realized that it wasn't so much that people had a why or even that they cared about them having found a why, but it was the curiosity, the fact that the curiosity was enough that they just spent so much time in it, they became really good and all these opportunities came knocking on their door.

They started it and there was no career path. There was no startup that was fit for their skills. But 20 years later, having done this, there was this perfect startup or this company for them to be perfectly placed to just enter into.

Ian Lee: I also think that, like, something that shaped my perspective and a lot of people's perspective is just that you see these success stories of people in their twenties, thirties, forties, fifties, whatever. make it to the mainstream in terms of either conversation or like media or whatever, and their histories are narrated in a certain way that makes it seem like from the moment that they were born.

Yeah. Straight line. You're always kind of like, yeah, there was always this like straight line, but you know, once you get older, plus, like, that was, I think, partially the residual from a previous generation, like our parents generation where you know, there was a very like kind of tried and true or stable path to success.

These days that's not really, the case anymore. And so I think that my perception of how you became successful was that you had to have a through line and you had to have like a vision from day one.

I think that unless you're in these like, kind of, specific industries and you have very high conviction in it for most people it's actually kind of a myth.

I wish I had realized that because I would've lived my life differently. If nothing else, , even if I had changed nothing about my decisions or the timing of it, at least I wouldn't have agonized over this for more than a decade.

And I would've just spent that time, you know, hanging out with friends, grabbing a drink, sitting on a beach, and just relaxing and just accepting the fact that no one knows anything. So that in of itself would've been incredibly valuable to me.

Ling Yah: But even though you said you had this realization of having not to agonize over having a long term plan, it was still part of your nature, wasn't it?

Just to plan, just to know. So how do you reconcile this new way of thinking versus your own innate personality?

Ian Lee: It's changed, it's rewired even how I work and how I plan. I don't plan as much anymore actually. And the way I create plans and the plans that I create are very different than the ones that I used to create a decade ago.

much to the, I guess, chagrin of like my colleagues. You know, I'm very capable of creating like ten year plans and strategies like it used to. But I don't see the value of them anymore actually. And so I don't create them. And so the types of plans and the ways that I work now are much more emergent.

They mostly focus on first principles. Like, what is it that I know and believe in and what is it I don't know, and don't, don't believe in, or don't care about or don't have enough information on. And it really like builds from there.

Like what is the little green that, is at the center of things. And just going from there. For example, planning a trip, , like as minor as it sounds like I don't create, you know, rigorous spreadsheets anymore.

It's just like, okay, there's a destination that we're going to and there's two or three kind of experiences that I really hope to gain from going there with my friends or family or loved ones or whatever.

So I just anchor on those things and then the rest of it, I just kind of go with the flow. Small examples like that, but it ladders all the way up even into more serious work. Like, company strategies and planning and things like that.

Ling Yah: Do you not think there is a space for long term visions?

Like even just personally, for instance, I need to plan enough for retirement. Something as simple as that.

Ian Lee: I do think that visions and beliefs about the future and how the world will look and core beliefs about problems that exist in the world and why they're so important and why they need to be solved are very, very valuable.

Those are things that, people should continue to develop actually. And that's one of the implicit things that I think I did gain.

So there's two things that you do gain from 10 years of working on ten year corporate strategies. One is the ability to actually articulate long-term problems, and I think that is really, really important.

And the second thing is actually on the other end of the extreme, the ability to take a, plan and then start to execute on it in the near term. All that stuff in the middle though is like, not particularly interesting. I, I think actually. And so instead of learning the whole thing, focus on learning those extremes, like how do you you know, execute a strategy or, a plan over 12 to 18 months, as I was kind of mentioning.

And then also in addition to that, how you build conviction around long term problems and beliefs. For example, in the world of, technology and entrepreneurship and things like that, and starting the company, you do need to have deep conviction in a long term problem.

The caveat though is that you, in my opinion, can't be too opinionated or rigid or stubborn about how that problem's gonna be solved exactly. And that's where I think like the, the difference is, is like, you know, the old me from 10 years ago would actually take that problem and then try to figure out every single step all the way up into that, problem.

When in reality, actually, like all you can do is build conviction around that problem. Identify a plan over the next year to year and a half to start to, get you on that path towards solving that problem. But more importantly, learning more about that problem. And then from there, just, continuing to fill in the details and continuing to build until you eventually get closer and closer.

That's I think the difference.

Ling Yah: You said several times you wish you knew then what you knew now. But would you really have done anything differently, apart from the agonizing part? Because you obviously loved art. You had to discover that art design wasn't for you, and then you went to consulting.

Clearly consulting played a tremendous role in your career, essentially in what you're doing right now. So I wonder if you had known what you know now, would you really have done something all that different?

Ian Lee: Yeah, I mean, I have thought about this and talked about this quite a bit, you know, obviously with family and friends.

You know, the one thing that is hard is that like, I really appreciate obviously like everything that I've gone through and where I am now. And so to go back and, and change something to potentially jeopardize everything that I've done and now have and where I'm going.

That's kind of tough to say, right? It'd be like, would you want to travel back in time and meet your prior self or meet your grandparents or something. But there's a risk that if you like, say hi to them, you, you may not be born. I don't know. It's a hypothetical, unknowable answer.

But I do think that all else equal yeah, I had known this earlier, I would've done a number of things differently.

Number one, I would've been more decisive actually. Because like when you're earlier in your life, at least for me.

When I was in my early twenties, like going into the work world, you know, everything is new and, I felt like I was experiencing everything for the first time.

In my early to mid twenties, I didn't have a lot of experience to have confidence in many situations, right? I was often second guessing myself and my own kind of decisions and intuitions about, everything including for myself, like what I should be doing with my time and what I should be directing my talents and, and energy towards.

I do believe that if I had learned this much earlier, let's say in like my teens, I would've built this muscle to actually start to trust my intuition more. It may be, may still continue to mean that I don't have as much experience or I don't have full confidence, but I would've been able to pick up on my intuition much more.

And because of that, I would've been more decisive about following my intuition much sooner. So an example is that, you know, I was in the world of consulting before moving into technology for about a decade. I probably would've moved into technology a lot faster.

And by moving into technology faster, I would've gotten closer and closer to, for example, where I'm now at, I believe, which is, startups, early stage you know, technology startups, very likely faster in my life than much later in my life. And, as an example, like would that have meant that I would've started the company earlier?

Maybe. Would that have meant if I had started a company earlier that I would've for example, had more experience through the growth and developments scaling of a company and potentially exiting of a company and then starting a new company, like maybe. So there's all these kind of like questions.

I do think I would've learned faster though because primarily I would've followed my intuition earlier.

Ling Yah: You tried so many things and you said following intuition as well, but you also need to know when to quit. How do you know when that time is and what is the best way to quit?

Ian Lee: That's an interesting one cuz I personally don't like quitting, but ...

Ling Yah: Is it because it feels like failure?

Ian Lee: No. I'm not afraid of failure. It's more, I'm afraid that I haven't given enough time to succeed. That's the thing that always, bugs me.

That that would be the thing that I would regret. Which is like, that I didn't put in enough effort or enough time to fully explore something to know whether it was a good decision or not. Or to be exposed to the, the other opportunities and rabbit holes that, that it may have presented if I had done that.

Those are the things that bother me or, or worry me. It's not like if I had fully explored something and, and I realize that there is nothing here. Actually, that's like a win in, in my opinion.

The answer to your question actually is both a very difficult one, but also a very simple one. Coming back to that 12 to 18 month emergent strategy thing that I was referring to at the beginning, it's like, what do you find most interesting?

Where is your energy pulling you at the moment? If it's pulling you towards something else, then that is your intuition and likely a signal that whatever you're doing currently is not the most interesting and compelling thing that you could be working on. And so people should just listen to their intuition or energy levels.

Like if you find yourself at your job thinking about other industries or even just something as simple as like looking at job boards to other companies or other industries, that's like an early sign that like maybe what you're doing is not the most interesting right now.

If you're reading articles during your breaks or on the nights and weekends about a totally different industry and you find yourself reading an article starting at 10:00 PM and because you're so obsessed with something, you can't fall asleep until 3:00 AM.

That's a signal that there's something out there that is more interesting than whatever you're doing. So over the years, like over the last 10 years, I've become very adept at, at listening to that. Like myself from many, many years ago would look at that and go, like, Ian, that is distracting you from your 10 year strategy.

For the last number of years when I feel that, I'm like, hmm, I'm actually gonna like, go even harder into that. To go see what's over there to know if that's like real signal or not. So when I get these intuition, that's a signal for me to go further into it as opposed to avoid it.

Ling Yah: How do you actually lean though? I mean, especially if it's a totally different industry. Do you just quit your current joint? Just jump straight into it? I mean, there must be some some plans?

Ian Lee: I mean another characteristic of me is that I'm not like some folks who are willing to just throw it all away and, change everything on a dime.

I'm a little bit more deliberate than that.

Maybe part of it is my upbringing or something, I'm not really sure, but my disposition, I'm not really sure. But you know, the way that I approach it is two guiding thoughts.

So I've made many career transitions in my life. Like, you know, I always talk about how I went from an artist into business. That was not easy. I mean, yeah, I was ridiculed by people when they looked at my resume and they said, Wait a minute, Like, you're applying to an investment bank and you're like an art major.

Like, why should I even be talking to you? But I made that transition. so I think that like, people think that transitions and transformations of themselves and the work that they do it's number one is a lot bigger than it should be. And number two, that it needs to be like super extreme.

Like you need to quit your job and like go do something else immediately. Or you need to quit your job and go to school or something to like focus on it then you can go do that thing.

I would say maybe like with traditional jobs in the past, if you like wanna transition from being an accountant to a doctor, okay, like, makes sense.

But for most jobs that are not like that in the world. The transition is actually not that extreme. It doesn't have to be a hard pivot on a dime. You can actually increment your way into industries.

That's something that I think I I've learned over the years, which is like taking a small incremental step and many small incremental steps over time is better actually than taking no big steps.

And furthermore, when you are passionate about something, like you really are interested in something like, as I mentioned, like, you know, you just can't stop thinking about it. You're just like obsessing about it.

I used to just think about technology and software, like when I was, working. I would wonder like, Oh, Leno, what is Google doing?

Like, what is their strategy as I was working at a helicopter company. When you're passionate about something, it makes taking a series of many incremental steps over a long period of time, much easier, right? It's almost like exercise or other things.

Let me give you an example. I hate cycling. I just hate cycling. Or I hate running. I hate, I hate running with a passion, but I do like going to the gym and lifting weights, right? So for example if I want to exercise the fact that I am more passionate about like lifting weights as opposed to running makes taking a series of incremental steps, like going to the gym one day and doing like 15 minutes of weight lifting, and then the next day, 20 minutes of weight lifting that much more easy than, for example, going out and saying, I'm gonna go run.

So like, I'll go run like a quarter mile and then go run a half mile. That is exponentially more difficult than me going to a gym and like just lifting for, increments of time. So in that same way, right, if you choose something that you're really passionate about, like let's say you're really interested in crypto or web three, you can just take a series of incremental steps by reading stuff, listening to podcasts, going to virtual or, or physical events.

And then just continually taking things bit by bit. Over time those things will accumulate to something where, by that point in time where you do wanna, for example, make a full-time transition or whatever, it doesn't look like you just did it yesterday. It's like, oh, you know, I've done all these things.

I've contributed in all these ways to this movement and community. And by that point in time it, seems extremely natural.

Ling Yah: You mentioned earlier the whole transition from art major to investment bank and being ridiculed. How did you make that transition? Cause I would've never guessed that you were even into art, given what you put out on your CV.

Ian Lee: Yeah. Yeah, Yeah, yeah. And to be honest, it wasn't until probably the last five to 10 years where the field of design, for example, and like artistic sensibilities have become a valuable thing in the business world. That was very much by happenstance. Like I ended up graduating from college with a double major in both design and also economics.

These days, like you look at that and you might go, Oh, like that makes all the sense in the world. You can do a lot with the combination of design and business. But back then when I graduated from college, it made no sense. Like the business world kind of looked at my design background and said, What the hell is that?

The design world said like, business has no business in the design world. I think I was like literally the first person ever to graduate with the design major plus something else that wasn't in the area of, arts.

Ling Yah: Were you not concerned during university? You must have realized how strange that was, but you still

Ian Lee: Yeah, mostly they were like two different sets of people.

Like, you know, I had my design and art friends that, you know, didn't overlap. Yeah. I mean, they went on to like do lots of interesting things like, go into the world of furniture or, other things.

And then I had my business and economics people who, became accountants and bankers and consultants and stuff.

And yeah, there were just two very different cultures. So I kind of had this like split persona in a way. In college, I never merged the two. They were like oil and, and water, you know? So how did I make that transition?

Well, I was really good at math, so , so that helped. They, you know, literally like some of these bankers used to test me on math, like in the fly, and I would do it fine, and they were impressed, I guess. So that helped.

I was very quantitative minded. When going into the world of finance, especially as like a junior analyst, they ask you very technical questions. I mean, ugh, this brings up like kind of scar tissue for me.

They ask you a common question, like, if a company has 10 million dollars of depreciation, walk through how it impacts every line item across the balance sheet, income statement and cash flow statement.

So as an art major, it would be kind of unexpected for an art major to be able to do that at a very low level of detail with accuracy, right? So that helped.

So what can you learn from that?

If you have extensible skills you have extensible skills, you should build from that and remind yourself that, even if you don't look like, you know, something that your skills and experience can still be applied as long as you understand the rules of those games.

The other thing that I think is an important lesson is that, I said earlier that people think that these transitions are a lot like bigger than they actually are.

Like when you or I were born or anyone was born, I had this idea where one day I wanted to be an engineer the next day or next week, I wanted to be a garbage man.

That was actually like my dream when I was a kid. I wanted to be like a garbage. No way. But why? Yeah, it was like cool, you know, I don't know. I liked the trucks and like, it was really cool. That was my dream when I, everyone else was like, I wanna be a president or an astronaut. I was like, I wanna be a garbage man.

That was unexpected. . Yeah. I really, I wanted to operate the, the garbage. Our ability to mentally project ourselves as a doctor, and then the next day a lawyer and the next day an accountant was very like, fluid.

We could mentally shift ourselves. Like we could even tell our parents or tell our friends one week where I'm like, I'm gonna be a doctor and then the next week I'm actually gonna be a business person, right? But as you get older, the time, delay between saying you're one thing and or thinking you're one thing and thinking you're another becomes very, very long actually.

Like, you form these thoughts where it's like, Oh, I'm a X right now and the world thinks of me as X right now. And to become y it's gonna be a three year transition. And I don't think that's the case. Like, I was able to pivot from art to advertising, to marketing, to finance, to consulting in a span of like all of that in a span of like two to three years.

And the way that you real you do that is actually through communication, both verbal and written, which is that people perceive you based on how you communi. So for example, when I was going into finance interviews as an art major, if I had communicated myself as, Hey, I'm a painter.

I love painting, but I'm also interested in finance and I just wanna try this thing out. And my skills might apply because I don't know. I'm really good at like creating new things. Like that's not the optimal way to communicate to an investment banker. So purely just through changing the way I would communicate and changing the way even I showed up in terms of my written communication, like my resume and stuff, and just reframing, I would say how my ex, what my experiences mean and how they might apply to a a different industry makes, can make a world of difference immediately.

not in three years, not in a year, but like literally immediately, which is, example, what I would go in with is I would would reposition my really small things like reposition my resume where instead of highlighting fine art at the top, I would actually highlight these business organizations like these business student clubs that I joined, right.

And center, kind of the conversation and my resume around that. And then when I talked about like what I did, right? So by the time I, I was applying to finance jobs, like investment banking jobs, I had experienced an advertising, you know, and marketing at that point in time and a little bit of exposure to marketing strategy, which actually does include financial planning and budgeting because you set up like media strategies and stuff like that, and you have to like, allocate a budget and stuff like that.

So instead of describing it as like, for example, I'm a marketer and like I know how to create marketing plans and therefore because I'm so good at marketing, I will be good at finance. I would instead frame it as I was exposed to financial planning and analysis through media planning.

And through that I've acquired skills in terms of, financial analysis, financial planning. I even created like a discounted cash flow statement for something that I was working on. And that is my passion and that's why I'm most interested in finance, right? And oh, by the way, I'm an art major, , like I happen to be an art major, right?

And an art major is, is useful because. allowed me to think, very creatively about how things connect, but oh, by the way, like, I have these test scores in, math and, and so on, right? So that, you know, that like, I, I can at least like do the basics that what I just described to you, that transformation in terms of the framing of your experience and your background and your interests.

I literally just didn't in, you know, the last minute people can do that for themselves in ways that are, you know, immediate and much faster than, for example, as I mentioned, this idea that you leave your job, you go to school for a number of years to make a career transition and then enter a new industry.

I think that things can be done in a lot faster, in a much more incremental way and likely as a result of the speed make a lot bigger of an impact over time.

Ling Yah: The fact that you were so aware of how to basically present yourself when you were just starting, you curious, Remarkable. I wonder if you were also getting advice from people around you who were telling you this is the way that you should present yourself.

And by extension, how do you find the right people around you to basically support you in what you're doing? Like mentors, for instance, that always a big topic that people

are interested in.

Ian Lee: Yeah, unfortunately, so, so one thing that's interesting is like, I actually didn't have people coaching me Oh wow.

When I was making that early transition in my life, which was actually both a blessing and a curse. I mean, I, I think I would've greatly benefited from mentors. I think I didn't know how to seek out, seek them out. I didn't know where they were. I didn't even know who they were because, people would look at my background like art and they would immediately again, like write me off.

They'd be like, This person's not gonna make it. So the way I learned was I literally went to career fairs at college. There are always career fairs, at college universities. And I would go to every single one of them. And what I would do is I would print out actually multiple resumes with different ways of positioning myself to different industries.

And I would. literally like beta test or ab test, different resumes and different pitches to different companies and industries. Every career fair. And at first it was really scary actually, because literally like the first, you know, several career fairs that I went to, I would get rejected by everyone , like, they would look at my resume and within a second just go like, Oh, nice to meet you.

Like, and then turn away, right?

That was very frightening and, and very demoralizing. Like, there were many moments where I was like, I should probably just give up. But you know, what I did was it started turning into a bit of a challenge for me.

Like the next career fair, I would go, Okay, like, well that didn't work, so what if I just changed one word on my resume? Or if I just changed a couple words and I, maybe if I made it a little bit different. And so the next career fair I would go to, I would talk to like 50 people and I'd only get rejected by 49 of them.

And I'd be like, Hmm, that's like progress. And then the next time I would iterate again. And then it'd be like, okay, 10 of them are actually like taking an interest in me and then so on and so forth. And so career fairs were actually like an amazing experimentation ground for me to constantly.

transform and innovate myself, and innovate my message and framing in very rapid succession and in a very intense way, right? There's like hundreds of booths, hundreds of people, and each time you can just, try and try again. Talk to someone doesn't work, go somewhere else, try something different.

Even go back to the same booth and talk to someone different who's on a different shift and see if that works, right? So I would literally do that hundreds and hundreds of times over, several years to the point where I became I think very skilled at it, purely out of necessity and, and the desire to get even like one job.

And at one point someone randomly took a, bet on me. that led to a bunch of things. Now, once I ended up finding a job then I started getting mentors through the managers that I had worked with. and that was incredibly helpful. You know, I, I had my first professional mentor was actually in the marketing area.

He was an ex McKinsey consultant. he's like, Oh, I, we used to work at McKinsey. I was like, I've never heard of that company. . Like, I don't know what that is. I actually didn't even know many years later that it was. McKinsey. But he exposed me to things He exposed me to financial models. he was like, you know, hey, look at this thing. Like, do you wanna work on this? I was like, I don't know. Sure. Whatever. and then when I went into finance you know, there were a lot of people that actually I didn't want to be mentors, but there was one who actually like gave me a number of mental tools and, and things that I've carried with me throughout my entire life.

And then eventually, you know, once you land somewhere, especially full time after college, I was fortunate enough to have a mentor that has been, really like one of my most important mentors throughout life, even, a decade after I left the company. Where he, he literally shaped how I think and how I work in those formative years and, and helped me really kind of build confidence and build intuition.

And so, I would say over, over the course of my life, I've probably had anywhere between five to 10, very important mentors. Which I think I was actually quite, I'm, quite a bit.

it's interesting because now, now that I'm older I'm fortunate enough to have a number of men like life mentors who, were kind of professional mentors, but now they're older.

Some of them are even retired, but they're like kind of more coaching me these days. Less on career and more on life, which is very valuable professionally. I find that a lot of my mentors are actually my peers or even people that are younger than me. And I have a lot to learn from them professionally.

So the way I seek mentorship and the way I get mentorship and the type of mentorship that I get has changed a lot. It's no longer kind of like a single role model figure. But it's actually just kind of a network and a community of peers and even people younger in their careers that I can learn from and that network and that community and fostering that and cultivating that and building that in a way that is actually like very complimentary.

You know, where the people in that network are not all the same. They actually have different skill sets, backgrounds, perspectives, life journeys. It's actually the composite of all of those people that makes, things very valuable for me because I, feel like I can learn a hundred x more than just from one person. And you know, when, when you get older in your, you know, later in your career and also these days given how complex kind of the world is and how complex the problems are, you need as many skill sets and experiences and expertise and, and mentorship as possible from an array of industries to be successful these days.

So that's how I think about mentorship now.

Ling Yah: How do you effectively foster these mentorship relationships? Since I'm sure they are very busy as well, and so time is valuable. How do you think about that?

Ian Lee: Yeah I mean, I think a lot of people have different philosophies in terms of how to do this and, they tweet a lot about it.

For me personally it's always started from a relationship where it's more like a friendship, like a mutual friendship in a way. Which again, can be with peers or people much younger than me where we just connect and bond on something. We start to care for each other, as people like human beings.

Like, I care about, you, you care about me you want me to succeed, I want you to succeed. And it starts from this place of kind. Caring about that person and wanting to help them do well, and achieve what, what they wanna achieve. So you know, they do that for me, I do that for them.

And it just kind of grows and nurtures into this, you know, very kind of beautiful relationship where there's things that I'm able to help them with and there's many things that they're able to help me with. And I think that in, in some ways, right? Like on their side, they feel like I'm providing, 10 x more value than they're giving me.

But it feels like that to me. Like, it feels like they're providing a hundred x more value to me than I'm giving to them. And just like kind of that repeated interaction and repeated kind of development of those relationships over time, just become really deep.

And at this point, I would say that that community for me is, you know, I actually quite large, like, there's probably at least 20 to 30 people currently that I would say I, I have that with at, a pretty strong level in different ways, but those relationships are, extremely valuable to me and important to me beyond just the professional thing. And it's because I actually genuinely want them, even if I get nothing from them, because I've already gotten so much. I just genuinely want them to be successful and be happy, right.

And if I can contribute in any way possible, like I'll do that. And I, I think that that ends up kind of reciprocating in the end.

Ling Yah: And that was the end of episode 110, part one.

The show notes can be found at www.sothisismywhy.com/110.

And do stick around for this Wednesday because we'll be meeting Ian again for part two. And this time it is with all things web three. How Ian got into banking. Was tasked with finding out about this thing called Bitcoin, why Ian believed in it so much he kept pushing it forward in Citi even though he was at risk of losing his job. How he then end up being the head of crypto and blockchain at Citi, why he left, and what he's trying to achieve at his current Web three company syndicate.

It's a great episode. So do stick around.

And please if you haven't done so already, please do leave a rating and review for this episode.

The entire podcast on whatever platform that you're listening to this on, because honestly, every rating helps this podcast to grow. And it's so hard to get the word out on what's happening on STIMY. So your help would be greatly appreciated.

Now, that's all from me.

And see you this Wednesday.

***

STIMY 110 Part 2: Ian Lee [Founder, Syndicate DAO] - Building the YouTube of Web3 Investing & Decentralised Social Networks?!

===

Ian Lee: So I was there and I was like super excited because we're the first bank to do something like this. It took us 18 months to build We beat, to market all of the other banks and competitors by 12 months. when it was announced, all these other banks came up to me and they're like, How did you do that?

You crushed us by a year. And so I was kind of like, euphoria, but something interesting happened. I was in the main conference stage when we were giving our announcement and it was only like 20% full. And I was like, The hell's going on here? Like, this is the biggest conference.

I know there are thousands of people here because I saw them all walk in. Where the hell are they?

What is going on? This is the biggest news of the conference. Citigroup just ships something in the space in production live. This is not like a theoretical piece of technology.

This is now live.

Ling Yah: Hey everyone. Welcome to episode 110, part two of the So This My Why podcast. I'm your host and producer Ling Yah, and today's guest is Ian Lee, co-founder of Syndicate, which is a decentralized investing protocol and social network backed by the likes of A16Z, IDEO, Uniswap, coinbase, Opensea, Circle and Ledger.

And also the former founding member of IDEO Colab and Head of Crypto and Blockchain at Citi. Now, Ian's stories developed into two parts, so if you haven't listened to part one, please do, because there we talked about how we should measure our lives, how Ian pivoted from art to design, then investment banking and consult.

How cancer changed his life, why we shouldn't make 10 year long-term plans and instead, pursuit of things that interest us most in 12 to 18 month increments and so much more.

Meanwhile, this episode deals with all things web three.

How Ian went into banking, was tasked with finding out this thing called Bitcoin, why Ian believed in it so much he kept pushing it forward even though he was at risk of losing his job. How he ended up being the head of crypto and blockchain city, why he left, and what he's trained to achieve for his current Web three company syndicate.

So are you ready?

Let's go.

You mentioned ,earlier your time at Citi, when you were ahead of crypto and blockchain. And you mentioned that you were basically tasked with looking into Bitcoin at the time for city, at a time where people were afraid they would be fired.

And I wonder if you could just share a bit about that period of just exploring Bitcoin and basically being a champion at a time where internally there wasn't any support at all.

Ian Lee: Mm-hmm. Yeah, I mean, it's not too dissimilar from me being ridiculed as an art major by, you know, bankers. They used to it now's also bankers, incidentally.

So I joined Citi's venture arm and innovation arm in 2014, this was before crypto. This was, you know, the word crypto. This is Before Ethereum, it was just bitcoin. 2014 was also a very bad year. Bitcoin hit an all time low, I think, of like 150 or $175 in 2014.

It had crashed from $1,200 because of Mount Gox in late 2013, early 2014. And because of Mount GOs you know, which was a very big event in the Bitcoin and, and crypto space, it led to this really protracted, bear market in Bitcoin and crypto for years until, I would say 2017 is, when things, 20 16, 20 17 is when things started coming back.

And so if you think about that time, right, it was actually a very bad time to be in Bitcoin as an entrepreneur, as a vc and especially as someone at a bank, when figures like Jamie Diamond, that JP Morgan were saying very publicly that Bitcoin was a fraud and it was a useless technology that was, going to, die.

And so I came in in 2014 and, I was a new guy and I tell the story a lot because it's an example of where it's very random and. Is that the first two weeks? Well, the first week that I joined the company, I went in the office and my computer that was being issued by it hadn't arrived.

And it wasn't going to arrive until later that week. So I was sitting at my desk with no computer and nothing to do.

I went around and said hi. And after I had done that, and I still had nothing to do I went to my manager and said, I have like a good few days before my computer comes, like, is there something that I can, look into while I'm sitting here?

And her name's Debbie. She became one of my greatest life mentors and I still keep in contact with her to this day. She was like, Yeah, why don't you look into this thing called Bitcoin? Because no one's looking at it. Most people don't think it's that interesting. They're pretty skeptical, but I don't know.

I've been hearing that a lot of developers and entrepreneurs are like building around it or something and I was like, Okay, sure. I don't know what this thing is, but I'll go look into it and let you know in a couple days. So googled bitcoin, What is Bitcoin like, and it brought me to Satoshi NATO's White paper.

And I asked one of the people in the office to help me print it out because I, again, I didn't have a computer. I started reading this white paper, this 10 page pdf, that was actually, released on October 31st Halloween of 2008. and I read it and I was like, okay, first of all, I was like, Whoa, this is very different.

I have no idea. This, looks like hieroglyphics to me. And number two, it was deeply mathematical. And so I was like, that's really interesting. Like, I love math. I hadn't, you know, done anything that was professionally related to math in more than a decade. And I was like, this seems kind of fun.

And it was, if any of you have read the Bitcoin White paper, which I think everyone should, it's very dense. Mm. And surprisingly short. It's surprisingly very short, but it's very concise and dense. Like it doesn't, Walk you through any background or anything, it just jumps straight into things like shot 2 56, like encryption methods and stuff.

And it doesn't like provide any, context. It just says like, we're using, you know, shot 2 56 for xyz, right? So these are all new concepts to me. I open up my personal computer and I start just Googling and wikipedian all these terms, and literally what I thought would take me just 30 minutes, it ended up taking me three full days to read that white paper and actually understand the concepts of what all these things were referencing.

And at the end of those three days, I was looking at it and everyone was at the time, especially at the bank, saying, Okay, this thing is a digital currency. It is a fake currency for money laundering and, elicit payments. And what I saw was something totally different.

What I saw was an open stack, an open FinTech stack. That's, that's what I saw in the white paper. It didn't have a word which ended up becoming blockchain as a platform, right? It didn't have a word, but I knew that what I saw in it was a platform. A technology platform for FinTech that was completely open.

And the reason that that was so powerful to me was because prior to joining Citigroup, at my consulting company, as I was mentioning earlier at Deloitte, I was studying the impact of SAS and AI on different industries, right? And one of the biggest disruptions in the world of software was SaaS, but also APIs, right?

And one of the biggest disruptions was actually these open software systems like Android and iOS, where via their STKs and even Facebook and other companies were doing this via their STKs, they were enabling ecosystems of external developers to build applications on top of their platforms.

And that was disrupting, you know, many areas of software and many industries, right? So when I looked at Bitcoin, that's what I saw I a open software system for FinTech applications that actually didn't even have APIs. It was just completely open, meaning anyone could build an app, a FinTech application on top of Bitcoin without even, having to be permissioned into an open into an API based system.

And furthermore, that system was completely decentralized and lived openly on the global internet. And when I realized that within, you know, it took me again, like three to four days to read through that, I knew that this thing was way bigger than a digital currency. And so within that first week I went back to my manager at the end of the week and I said hey, this Bitcoin thing that you made me like, go look at, number one, it's super interesting.

it's really, really interesting. And number two, it's way bigger than the bank is thinking. And people are thinking, and I think that we need to invest in this more. And she was an executive actually from Apple and eBay and other places. So she's seen kind of like how these kind of small innovations, particularly in the developer side have impacted different industries.

So she was like, Let's do it. Like, so what we did was we started. Actually utilizing a lot of the capabilities that, we were in possession of to fund research and development across Citigroup inside of the IT organizations in different parts of the bank to understand more deeply at a technical level the architecture of Bitcoin and how it might be utilized to be applied by the banking sector and, and companies like Citigroup in a way that made sense.

But while we were doing those things and I was, starting to tell more and more people in the bank that, Bitcoin and then eventually blockchain was going to be a really big deal, there was incredible resistance. Most of those people they didn't come from the world of technology.

They came from the world of finance or business. Most of them, you know, were on the Jamie Diamond party line, that this thing was the fraud. Many of them advised me that, if I wanted to have a career at Citigroup, that I should stop looking into Bitcoin and stop working on it.

And, you know, coming all the way back to where we started, right? It was one of those things where it was like, okay, the better thing that everyone is telling me for my career is. Focus on, X, Y, and Z. But what I'm genuinely most interested and I really believe in is this, whatever this thing is, which I'm not really sure where it's going, what it's gonna develop into.

I had no idea that Ethereum was gonna, eventually come about and all these other things after that. But, you know, I was just interested in it and, and the problem space that it could potentially solve. And I just went into that, I mean, obviously I did my job and did it well, but I found more and more time, especially on the nights and weekends even to investigate this technology and, spend more time in it.

I went to conferences, the Bitcoin community was obviously very small back then and like it was very weird for a city group person to be showing up much less like supporting it publicly.

Ling Yah: Did they look at you suspiciously? Cuz you're from an institution?

Ian Lee: Yeah. Yeah, they did. Definitely. I mean, a lot of them were, you know, the, the CI for punk folks which you know, I've, I've become friends with a lot of them.

The is precisely to overthrow you. Yeah, exactly. Exactly. But I think like, you know, they saw maybe like in me, like an ally or something.

Maybe they saw an ally in me to help them with their cause or something, which, you know, genuinely I was there because I was interested to learn from them.

And potentially collab, at some point collaborate with them. So I started, getting involved in a startup accelerator focused on Bitcoin. publicly giving talks in public support and Bitcoin while I was at the bank started engaging in a number of internal activities across the bank to develop further, develop the technology and understand its capabilities and limits.

but that was a very interesting time and I just went with what I thought was most interesting and, and it just so happened that, six to nine months later one of the biggest events was that Goldman Sachs decided to invest in circles, I think 30 or 50 million series A.

And that turned a lot of heads in the banking industry where people were going, Wait a minute, if Goldman's doing that, Are we the stupid ones? And so at that point, you know, I wish, I wish it was because of my own skills and, my own ideas, but it was because of that, that actually, like, I started getting invited back into these, board meetings or, executive meetings where they were saying, Okay, what is this Bitcoin thing? And like, tell us about it.

Tell us why you think Goldman is, interested in this thing. And, because I was like the only guy who had been pulling on that thread in the bank for so long, I became the head of crypto and bitcoin during that time but it was, months and months of, colleagues thinking that I was basically wasting my time.

Ling Yah: Weren't you working with Ken Moore as well, who was head of city innovation labs, that was in Dublin and you were mining city coin? What was that experience like? ?

Ian Lee: Yeah. Ken Moore. Yeah. Yeah. If Ken Moore is listening to this tell him email me please. After all these years. And Dave Fleming as well, and Maya Laich, who are all at MasterCard now.

And Ken Moore is now head of innovation at MasterCard, the Chief Innovation Officer at MasterCard, which is amazing. So, yeah, Ken Moore he was the head of the innovation lab in Ireland which was one of the most advanced in terms of technical development research and also have been one, one of the, actually the area, the pla the lab where we developed most of our.

Technical capability in the area of blockchain. And one of the first projects that, that my manager and I had funded was this research and development project.

We literally forked the Bitcoin network and started running it internally on cities systems to understand how the consensus mechanism worked, how the ledger kind of updated how mining worked, like conceptually and, technically.

We forked the Bitcoin network and ran it. We weren't mining Bitcoin on the public network but we were, you know, mining I guess on the fork of Bitcoin. And we actually forked a number of other systems interestingly to understand the differences between these consensus mechanisms.

Ones that were more decentralized, like Bitcoin and then ones that were more centralized, and then ones that were kind of like hybrid in the middle. And we were running these things first to understand them and then second to see if we could overlay actually like a payment system and a payment solution on top of these things and what that would look like and what the pros and cons of those were.

And so that project was dubbed Citi Coin. Honestly kind of as just an internal code name for that project. It wasn't necessarily to like actually design a, a city group coin, but there was a conference that Ken Moore was at, which if he's listening to this, he'll laugh at where, you know, it was like a two to three hour conference with a bunch of press there.

They were asking about things that Citi was working on and excited about. It was like two to three hours long and there was this one little snippet where he mentioned the Citi Coin project, 10 seconds. And it was just that, that got picked up in Tech Crunch Mark and started tweeting about it. we started getting calls from regulators saying, Are you building a cryptocurrency?

And, this is not okay. So it created a bunch of problems for Ken Moore specifically. So that's how all the articles came. . Yeah. Yeah, yeah. And that was like 2014 I think, or 2015 at the latest. But we were pretty, far ahead in our understanding of like the technology and its applications and its limitations.

And you know, that was the first project, but by the time I had left Citigroup two years later, we had over 30 internal projects dozens. Initiatives, like projects that had turned into serious initiatives and over a half dozen external investments into blockchain startups.

So, it started with that, but by the time I had left in 2017 we were pretty far along. Unfortunately, I left Ken Moore, left, Dave Fleming left. A bunch of other people left that were kind of, part of that core. I think kind of stagnated for a little bit. I know that they've been more active recently in terms of hiring up in the digital asset space. But you know, Ken Moore, myself, Dave Fleming and a number of others were sort of at the center of a lot of the development at Citigroup.

Ling Yah: When you left, wasn't Citi one of the most active institutional banks investing alongside Goldman and Google?

Ian Lee: So what was it that, Yeah, yeah, there was a chart actually that show I think there's like CB Insights and the top, Yeah. Three organizations by a long margin were, yeah. Google Ventures Goldman and Citi Ventures, or Citi Group.

Ling Yah: Why do you decide to leave when clearly you had won the battle and Citi was interesting, entering the stage?

Ian Lee: Well, I, I would, I would not say that we won the battle. much less, have they won the battle. I guess this is all connected, right? Funny story is that in 20 17, I went to the biggest conference in the industry called Consensus by CoinDesk, and it was in New York.

And that year there were, I don't know, several thousand people. It was like the biggest conference blockchain conference in history at that point in time, the Wall Street Journal, like everyone was there. And I was really excited because we were launching a product that I had helped fund and build and even conceive.

And it was a payment network built on a blockchain system that was in active production with live customers like nasdaq, like really big customers. And it, even showed up in the Wall Street Journal that day that we announced it at the conference at consensus on the main stage.

So I was there and I was like super excited because we're the first bank to do something like this. It took us 18 months to build We beat, to market all of the other banks and competitors by 12 months. when it was announced, all these other banks came up to me and they're like, How did you do that?

You crushed us by a year. And so I was kind of like, euphoria, but something interesting happened. I was in the main conference stage when we were giving our announcement and it was only like 20% full. And I was like, The hell's going on here? Like, this is the biggest conference.

I know there are thousands of people here because I saw them all walk in. Where the hell are they?

What is going on? This is the biggest news of the conference. Citigroup just ships something in the space in production live. This is not like a theoretical piece of technology.

This is now live.

Where the hell is everybody? So I, I went outside and I started looking around and down the hallway in this little side conference room, where they had different breakouts in this one breakout room. There were hundreds of people streaming out of this door,

And I was like, What the hell is in that room? There's something going on in that room that I don't know about.

I nudged my way to that door because you literally couldn't get in. There was standing room only, it only had capacity for maybe like a hundred to 150 people, but there were literally like 500 people kind of like trying to get in.

And I, was sort of like looking over people's shoulders and through the doorway at the stage I could peer and peek at a few people on that stage. And one of them was Vitalic and he was on that stage and he was talking about this new standard that had launched on Ethereum, which at that point in time, had just been launched.

Like it was super early and everyone was like, especially in the enterprise space, super skeptical of it.

Oh, this thing is like not gonna be a thing.

And he was talking about this standard that they had just had launched and created on Ethereum called ERC 20. And I was like, The hell is ERC 20?

everyone was talking about ERC 20. So I went back to San Francisco cuz the conference was in New York, after it had ended. And I was like, what the hell just happened, Like the whole industry, like was focused on blockchain now, all the smartest developers and startups are talking about ERC 20, what does this thing rrc?

20. So I start like the Bitcoin white paper reading into ERC 20 and what ERC 20 obviously now is, but it was back then was this standard for anyone to be able to launch their own fungible token on top of Ethereum. And I was like, What the hell is this? Why would you do this? Why would anyone wanna launch their own cryptocurrency?

on Ethereum, much, much less. And then this concept of a decentralized application that would utilize that ERC 20, Like, why would anyone do that? And so I literally just started going down the rabbit hole again. I didn't know what it was. I, couldn't tell if it was real.